Services Provided

VaR Calculation and Asset Liability Management

For Banks

Based on Basel III regulations, the Fundamental Review of the Trading Book (FRTB) contains a detailed set of capital rules that will be applied to the banks’ wholesale activities. NtSaaS is able to complement the banks’ internal models and enhance the market risk, credit risk or integrated market and credit risk measurement and analysis.

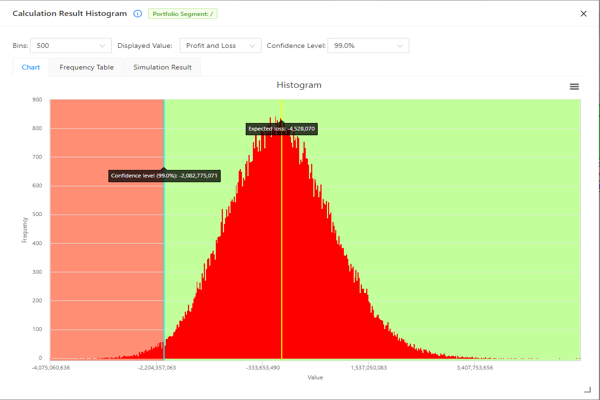

In NtSaaS, the 3 major Value at Risk (VaR) calculation methods for market risk are implemented, namely Variance-Covariance, Historical and Monte Carlo simulation. Expected Shortfall (ES) can also be calculated in addition to VaR. Credit VaR is calculated using the Monte Carlo simulation and is consistent with Basel methodology. The OLAP feature allow users to analyze their portfolio in segments according to transactional attributes.

For Insurance Companies

Based on Solvency II regulations, NtSaaS can calculate current and future market and credit risk to meet the Own Risk and Solvency Assessment (ORSA). In NtSaaS, the 3 major Value at Risk (VaR) calculation methods for market risk are implemented, namely Variance-Covariance, Historical and Monte Carlo simulation. User-defined scenarios allows user to perform stress testing on their portfolio.

For Banks

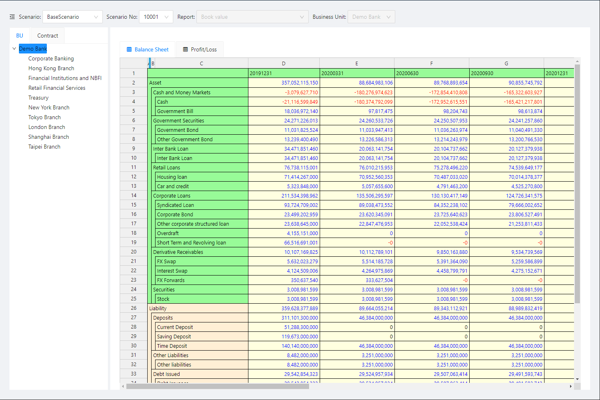

NtSaaS offers a wide range of analytical solutions related to ALM. Not only are traditional ALM reports such as maturity ladder, cash flow ladder and BPV/GPS reports are displayed, NtSaaS also caters for other analytical reports such as Income Gain, Income Yield Rate and Capital + Income Yield Rate that can be used for KPI and future analysis.

NtSaaS can handle Interest Rate Risk in Banking Book (IRRBB) regulation to display the values of ΔEVE and ΔNII based on the 6 Basel prescribed stress scenarios for each currency.

In addition to the run-off balance sheet and constant balance sheet calculations for IRRBB, NtSaaS also has a Business Planning feature, which support dynamic portfolio simulation for more comprehensive analysis.

For Insurance Companies

NtSaaS provides useful information for Enterprise Risk Management (ERM). Firstly, it allows for business planning on the company level. It also supports the establishment of asset allocation strategy. NtSaaS not only supports the simulation of the asset side cash flows but also the insurance liability side cash flows. NtSaaS can not only show the balance sheet on a historical cost basis, but also on a mark-to-market basis.

NtSaaS is also flexible and allows users to input external liability cash flows generated by other Actuarial systems.