| Accounting reports and methodology |

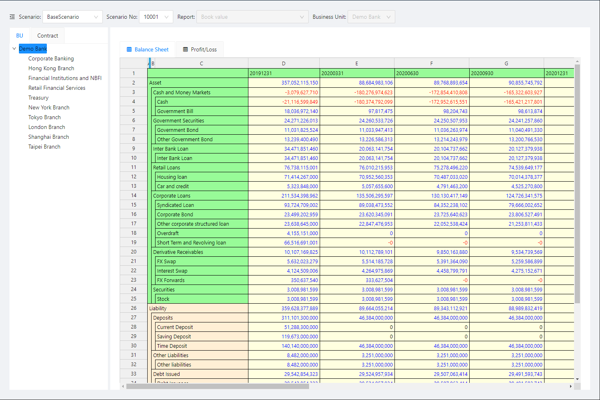

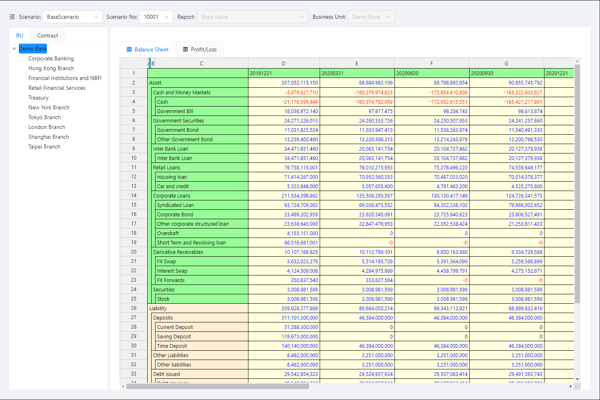

Balance Sheet (BS), Profit/Loss Statement (P&L), Financial Indicators |

|

|

| Multiple future evaluation dates |

Specify any number of future dates |

|

|

| Accounting method |

Historical cost, Mark-to-market, Impairment |

|

|

| Fund Transfer Pricing |

Supports up to 5 Fund Transfer Pricing for business units |

|

|

| Financial Closing |

Supports the accumulation of net profit/loss and tax payable |

|

|

| Financial Indicators |

Financial Indicator can be customized by formulas |

|

|

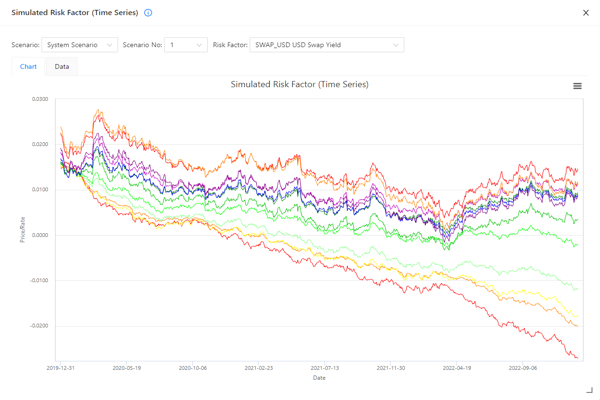

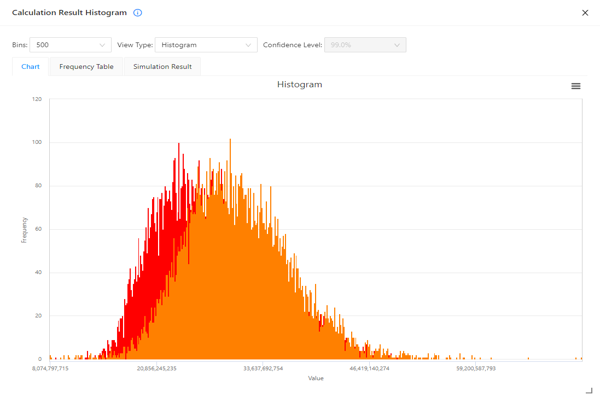

| Scenario Type |

Market Scenario |

|

|

| Base Scenario |

Scenario where the economic environment does not change from base date |

|

|

| Forward Scenario |

Scenario where the interest rates are based on the forward rates as of base date |

|

|

| User-defined Scenarios |

Supports scenario analysis and stress testing |

|

|

| Composite Yield |

Composite yields are the yield indices calculated from market yield |

|

|

| Credit Scenario |

Based on Merton Structural Model (Merton [1974]) |

|

|

| Integrated Scenario (Market + Credit) |

|

|

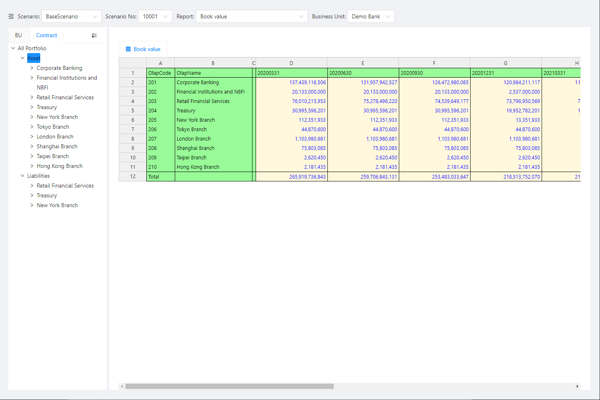

| Portfolio Analysis & Evaluation |

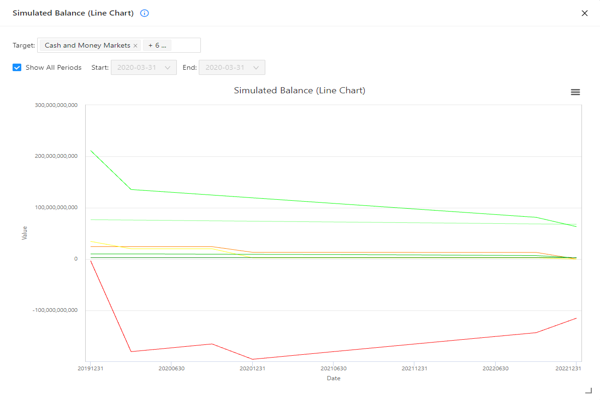

Balance Report |

Book Value, Fair Value Balance |

|

|

| Profit and Loss Report |

Income Gain, Capital Gain |

|

|

| Ladder Report |

Maturity Ladder, Cash Flow Ladder |

|

|

| Risk Indicator Report |

BPV, EXPOSURE |

|

|

| Spread Adjustment |

Spread will be internally calculated for the adjustment of initial market value |

|

|

| Fair Value calculation |

Fair value calculation method can be specified at individual transaction level |

|

|

| Supported Financial Instruments |

Interest related product |

Loan, Deposit, Bond, Swap etc. |

|

|

| Spot and Forward products |

Stock, Fund, FX etc. |

|

|

| Results Display |

Financial Statements at future evaluation dates |

Future Balance Sheet (BS), Profit/Loss Statement (P&L), Financial Indicators |

|

|

| OLAP (Online Analytical Processing) |

Allows analysis by segments according to Transaction attributes |

|

|

| Balance Report |

Book Value, Fair Value Balance |

|

|

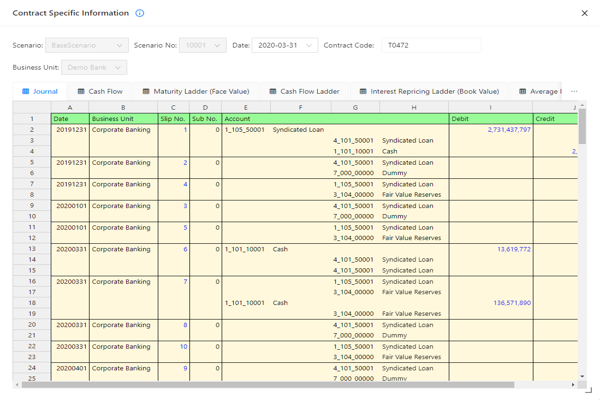

| Ladder Report |

Maturity Ladder, Cash Flow Ladder |

|

|

| Detailed transaction information |

Journal, Cash Flow Table etc. |

|

|