VaR Calculation

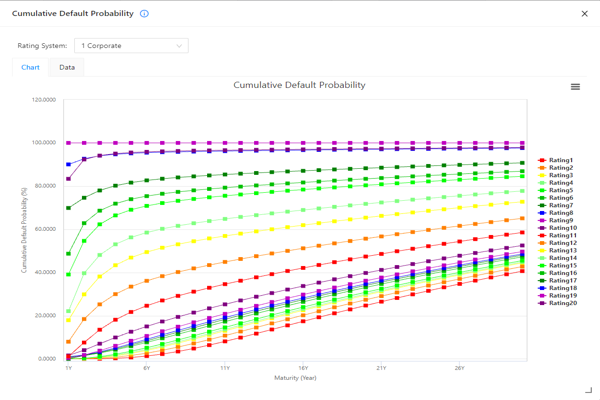

Credit Risk Management

Credit Risk Professional

Methodology

- Monte Carlo Simulation

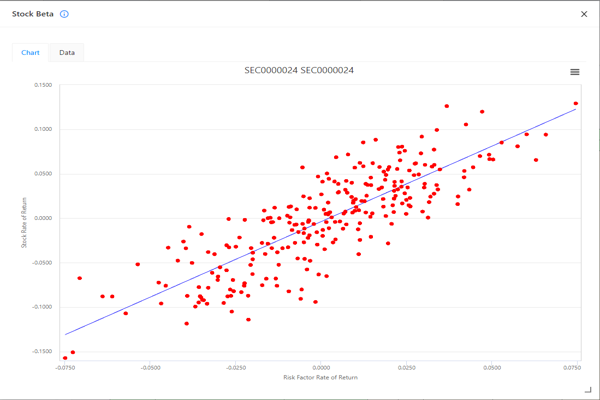

- Based on Merton Structural Model (Merton [1974])

- Mersenne Twister, Numerical Recipes ran2

- Quadratic resampling, Probability matching

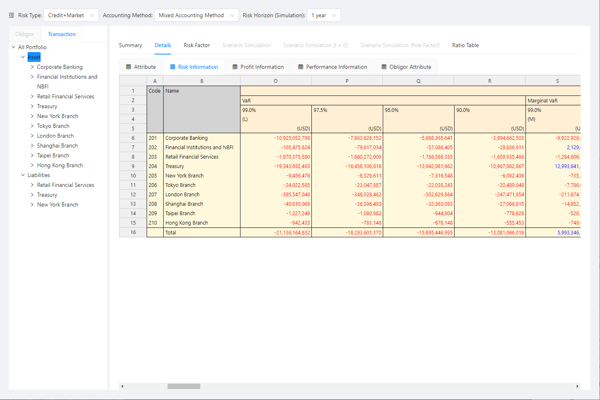

Portfolio Analysis and Evaluation

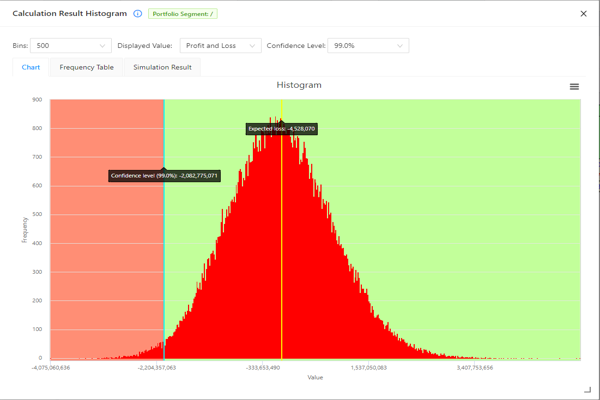

- Expected Loss, Unexpected Loss, VaR, Marginal VaR, Conditional VaR, Risk Contribution

- Display aggregated values via Obligor or Transaction level

- Evaluation method can be defined at the individual transaction level

- Supports three types of Fair Value calculation methods

Supported Financial Instruments

- Interest related product (Loan, Bond)

- Spot product (Stock, Fund)

Results Display

- OLAP feature allow users to analyze their portfolio in segments according to Obligor or Transaction attributes

- Aggregated transaction information (VaR, ES, Book value, Market value, Profit/Loss etc.)

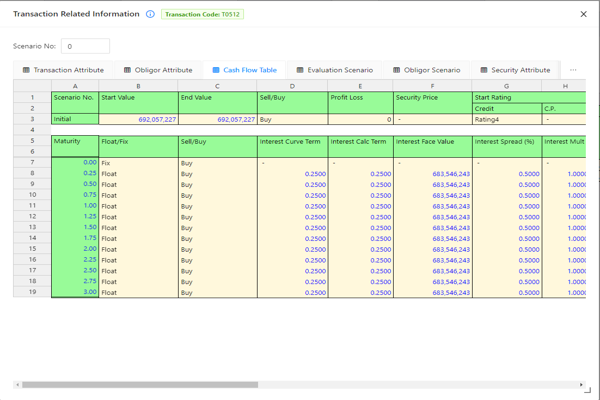

- Detailed transaction information (Cash Flow Table, Evaluation Scenario and Exposure etc.)

Market Risk Management

Market Risk Professional Lite

Methodology

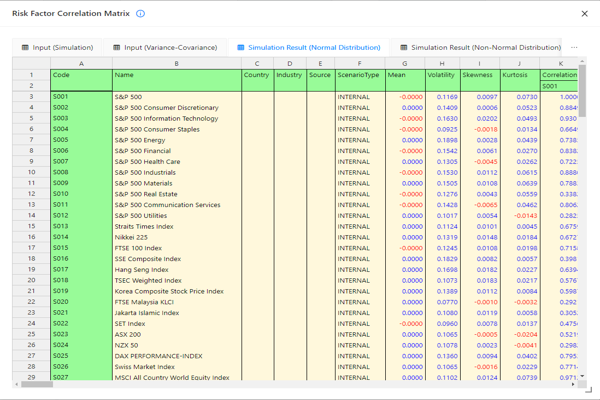

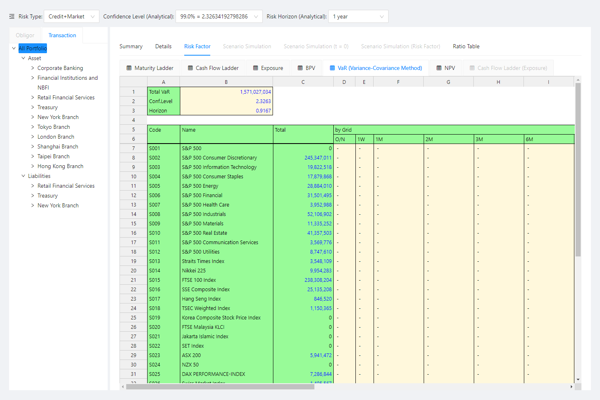

- Variance-Covariance

- Historical Simulation

Portfolio Analysis and Evaluation

- Expected Loss (EL), Unexpected Loss (UL), VaR, Marginal VaR, Conditional VaR

- Sensitivity Analysis (Duration, BPV, Modified Convexity)

- Option Greeks (Delta, Gamma, Vega, Rho)

- Supports three types of Fair Value calculation methods

- Supports prepayment

Supported Financial Instruments

- Interest related product (Loan, Deposit, Bond, Swap etc.)

- Spot and Forward product (Stock, Fund, FX etc.)

- Option Product (Stock, Index, FX, Swap, Bond)

Results Display

- OLAP feature allow users to analyze their portfolio in segments according to Obligor or Transaction attributes

- Aggregated transaction information (VaR, ES, Book value, Market value, Profit/Loss etc.)

- Ladder report (Maturity Ladder, Cash Flow Ladder, Exposure, GPS etc.)

- Detailed transaction information (Cash Flow Table, Evaluation Scenario and Exposure etc.)

Market Risk Professional

Includes all features from Market Risk Professional Lite with the added features below.

Methodology

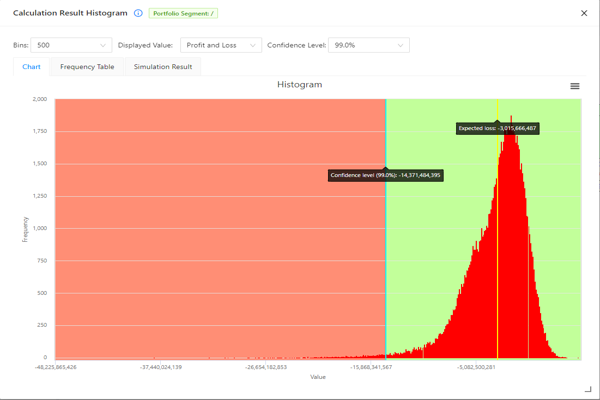

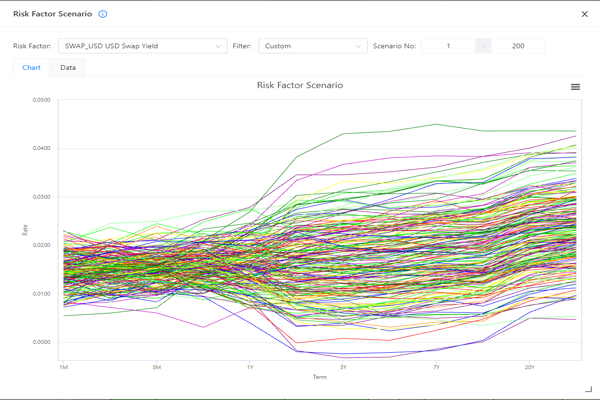

- Monte Carlo Simulation

- Principal Component Analysis (PCA) Monte Carlo Simulation

- Yield curve extrapolation using the Smith-Wilson method

- Mersenne Twister, Numerical Recipes ran2

- Quadratic resampling, Probability matching

Integrated Market and Credit Risk

Market and Credit Risk Enterprise

Includes all features from Credit Risk Professional and Market Risk Professional with the added features below.

Methodology

- Integrated Market and Credit Risk calculation

- Monte Carlo Simulations will support up to 1,000,000 iterations

Portfolio Analysis

- No limitations on OLAP segments

- Supports restructuring of OLAP segments

Feature Comparison

| Credit Risk | Market Risk | Market and Credit Risk | ||||

|---|---|---|---|---|---|---|

| Professional | Professional Lite | Professional | Enterprise | |||

| Methodology | Monte Carlo Simulation | Market + Credit Risk | ||||

| Credit Risk | ||||||

| Market Risk | ||||||

| Historical Simulation | Market Risk | |||||

| Cumulative Historical Simulation | Market Risk (Profit/Loss calculations are always based on the value of the instrument at t=0) | |||||

| Variance-Covariance VaR | ||||||

| Merton Structural Model (Merton [1974]) | ||||||

| Random number generator | Mersenne Twister, Numerical Recipes ran2 | |||||

| Convergence Improvement | Quadratic resampling, Probability matching | |||||

| Yield Curve Scenario | Principal Component Analysis Monte Carlo Simulation | |||||

| Extrapolation using the Smith-Wilson method | ||||||

| Portfolio Analysis and Evaluation | VaR Indicators | EL, UL, VaR, Marginal VaR, Conditional VaR | ||||

| Risk Contribution | ||||||

| Sensitivity Analysis | Duration, BPV, Modified Convexity | |||||

| Option Greeks | Delta, Gamma, Vega, Rho | |||||

| Aggregated display | Transaction based or Obligor based | |||||

| Accounting method | Historical Cost or Mark-to-Market at individual transaction level | |||||

| Fair Value calculation methods | ||||||

| Prepayment | Fixed deposit, Mortgage loan etc. | |||||

| Supported Financial Instruments | Interest related products | Loan, Bond | ||||

| Loan, Deposit, Bond, Swap etc. | ||||||

| Spot products | Stock | |||||

| Spot & Forward products | Stock, Fund, FX etc. | |||||

| Option products | Stock, Index, FX, Swap, Bond | |||||

| Results Display | OLAP (Online Analytical Processing) | Allows analysis by segments according to Obligor or Transaction attributes | ||||

| Aggregated transaction information | VaR, ES, Book value, Market value, Profit/Loss etc. | |||||

| Detailed transaction information | Cash Flow Table, Evaluation Scenario and Exposure etc. | |||||

| Ladder report | Maturity Ladder, Cash Flow Ladder, Exposure, GPS etc. | |||||